In the mid - 1960s conventional wisdom or motherhood for retirement planning said that you should take all of your investments and put them into government bonds or fixed income type products. The thinking was that you could not afford to take any 'risk' in your retirement years. Thus it was believed that guaranteed investing was the best approach to retirement planning and they were correct at that time.

Unfortunately this type of thinking still permeates much of the current 'wisdom' or conventional thinking as repeated endlessly by the media and other sources, as the 'truth' about retirement planning. But is this bit of motherhood still relevant today?

This reminds us of a story about a woman who was preparing a Christmas dinner for her family and cut the end off of the roast. The daughter asked why she did this and Mom said: 'I don't know. That is how Granny always did it. Go ask Granny in the living room why she did it that way.' Granny's response was that the pot she used was too small and that is why she always cut the end off of the roast. So some 40 years later the behaviour continued without any thought or questioning even though they now had access to bigger pots!

In the mid - 1960's, before the introduction of the Canada Pension Plan, the average life expectancy of someone who retired at age 65 was four years or age 69. This makes sense when you consider the quality of medical care and the more physically demanding labour that was the norm in the previous 100 years. Therefore why take a chance in the equity markets when you only had four years to live!

Today, the average retired couple, age 65, has an actual expected life expectancy of 30 years. One of the couple has a 50% chance of living beyond age 90 and in fact the age 85 and over demographic is reported to be the fastest growing slice of the population in Canada. So does the retirement advice from the 1960's with average life expectancy of four years still make sense today when implementing your investment strategy? That is one part of the dilemma facing today's retirees: safety versus life expectancy.

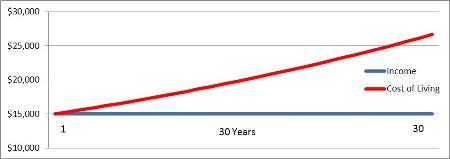

The other part of the dilemma arises from this desire for safety. For example: you are retired and you invest $500,000 in a Government of Canada Bond for 30 years with an interest return of 3% (approximate current yield for illustrative purposes only). The income is $15,000 in year one of your retirement. Let's further assume the income is sufficient to meet all of your living expenses.

Then we ask clients: What happens to your car insurance in Year Two? Property taxes? Hydro rates? Transportation costs? Food costs? Most people answer that they go up! In fact most government budgets, municipal, and so on, assume at least a 2% annual revenue increase and most civil servants assume their wages will rise annually as well.

So the real challenge is the growing gap over time between your 'safe' interest income and the rising cost of living during your retirement years. We will address this in Part 2 in our next article.

Please call us today to discuss your retirement income needs and how we can assist you in meeting them.

Questions about retirement planning?

Contact our office today !

Copyright © 2013 AdvisorNet Communications Inc., under license from W.F.I. All rights reserved. This article is provided for informational purposes only and is not intended to provide specific financial advice. It is strongly recommended that the reader seek qualified professional advice before making any financial decisions based on anything discussed in this article. This article is not to be copied or republished in any format for any reason without the written permission of AdvisorNet Communications. The publisher does not guarantee the accuracy of the information and is not liable in any way for any error or omission.